The Upgrade Cash Rewards Visa will improve your credit card experience! This cutting-edge card offers a number of features that make managing your finances easier and more fulfilling than ever before, with the goal of revolutionizing the way you spend and earn rewards. The Upgrade Cash Rewards Visa includes everything you need to get cash back on regular purchases, have access to individualized financial tools, and have a smooth online banking experience.

You’ll experience a whole new level of flexibility and convenience with this card. The Upgrade Cash incentives Visa is changing the way you use credit cards by offering substantial cash incentives as well as contemporary banking capabilities. With a credit card that prioritizes your needs and preferences, you may discover a world of financial possibilities and take charge of your spending. Apply now to see the Upgrade difference for yourself!

Getting Incentives

The Upgrade Cash Rewards Visa makes it easy and enjoyable to earn rewards. Every purchase you make will earn you 1.5% cash back, so you can optimize your benefits even on regular purchases. Every transaction, whether you’re paying bills, eating out, or shopping for groceries, adds up to important cash back that you can use to reduce your amount or redeem.

This card gives you the resources and skills you need to manage your finances while rewarding you for living your life, from exceptional events to everyday necessities.

The Upgrade Cash Rewards Visa makes earning rewards simple and fun, with no upper limit on cash back earnings and an easy-to-understand rewards system.

Redeeming incentives

Making the most of your cash back earnings is possible with the Upgrade Cash Rewards Visa thanks to a simple and satisfying redemption process. The following is how to use your rewards:

- Versatile Redemption alternatives: To accommodate your tastes, the Upgrade Cash Rewards Visa provides a variety of versatile redemption alternatives. You have the option to lower the amount you owe by using your cash back incentives as a statement credit to your card balance.

- Direct Deposit: Getting your cash back earnings sent straight into the bank account you’ve linked is another practical choice. This gives you immediate access to your income for savings or other requirements.

- Gift Cards: You may exchange your cash back rewards for gift cards from well-known stores using the Upgrade Cash Rewards Visa. Gift cards from a large assortment of brands are a great way to spoil yourself or someone special.

- Donations to Charities: Upgrade is one of the credit card issuers that allows you to contribute your cash back rewards to charitable causes. This maximizes the impact of your rewards while enabling you to support causes that are important to you.

Take advantage of the flexibility and freedom to utilize your cash back rewards anyway you see fit, be it to pay off debt, fund a charity donation, or lower the balance on your credit card.

The Upgrade Cash Rewards Visa offers a smooth and satisfying experience for both earning and redeeming rewards, improving your financial health overall.

Principal Benefits and Extra Benefits

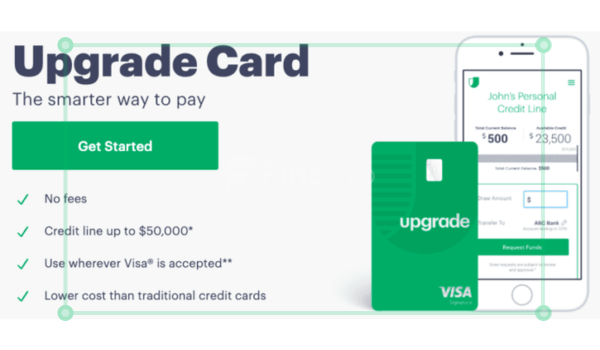

- No Charges: With the Upgrade Cash Rewards Visa, you can say goodbye to penalties associated with late payments, foreign transactions, and annual fees.

- Flexible Payment options: Take advantage of flexible payment options that let you manage your money on your terms and select the date of your monthly payment.

- Tailored Financial Instruments: Through the Upgrade mobile app, you may access individualized insights and financial tools that can assist you in tracking your spending, creating budgets, and reaching your financial goals.

Upon approval, you will have instant access to a virtual card, allowing you to immediately begin making purchases online and through mobile devices using your Upgrade Cash Rewards Visa.

- Contactless Payments: Use contactless technologies, such as Apple Pay, Google Pay, and Samsung Pay, to make safe and practical payments with your Upgrade Cash Rewards Visa.

- Set Monthly Payments: Take advantage of the stability that comes with set payments, which can help with financial planning and budgeting.

- Bonus Offers: To optimize your rewards potential, take advantage of exclusive bonus offers and promotions that let you earn more cash back on a few chosen categories or merchants.

- Update Your Mobile App: Use an easy-to-use mobile app to track your spending, manage your card, and make payments while you’re on the road.

- Credit Health Tools: Get tailored advice on how to raise your credit score and strengthen your finances.

Visa Signature Benefits: Take advantage of special Visa Signature advantages including extended warranty protection, roadside assistance, and concierge services.

- $200 incentive Offer: Enhance your financial journey by earning a $200 incentive when you open a Rewards Checking Plus account and use your debit card for three transactions.

Who is eligible to apply?

The requirements to apply for the Upgrade Cash Rewards Visa are as follows:

- Age: Candidates need to be at least eighteen years old.

Residents of the United States must apply.

- Income: Candidates must be able to provide proof of their source of income.

- Credit History: Those with average to exceptional credit are typically eligible for the Upgrade Cash Rewards Visa, though particular credit score requirements may differ.

- Bank Account: In order to be eligible for funding, applicants normally need to have a checking account.

How Do I Apply?

The Upgrade Cash Rewards Visa® application process is simple to use:

1- Online Request Form: To view the application, go to the Upgrade website.

2- Enter Your Personal Information: Provide the information required for identity verification and credit evaluation, such as your name, address, and financial details.

3- Send in the application: After checking your details and accepting the terms, submit your application.

4- Wait for Approval: A credit check is part of the approval process, but it has no effect on your credit score.

5- Delivery of Cards: After approval, you will receive your card through mail, ready to use and activate.

Answers to Common Questions (FAQs)

What is the Upgrade Cash Rewards Visa’s interest rate?

The APR varies according to creditworthiness, from 14.99% to 29.99%.

Exist any yearly charges?

No yearly fees are associated with this card.

How does the return on cash operate?

Every time you make a payment on a purchase, you receive 1.5% cash back.

What is this card’s credit line range?

$500 to $25,000 is the credit line range, subject to approval.