When booking a trip, it is essential to have a credit card like American Express Aeroplan Reserve with a high credit limit to cover the trip’s cost. Otherwise, if you are booking with cash, you are more likely to overspend. You should also have a debit card or PayPal to use if you need to refund, which is difficult with a credit card. A credit card helps you build a credit history, which could be helpful later in life.

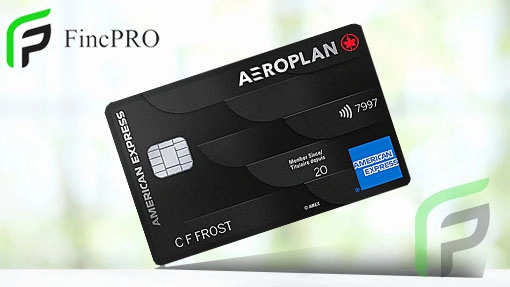

If you’re looking for that one card with the most benefits, the American Express Aeroplan Reserve Card is the one for you. With this card, you’ll have the flexibility of a hotel rewards program, the ability to earn Aeroplan Miles to use on flights, and the chance to earn Aeroplan Miles on purchases made outside your home country. You’ll have access to Aeroplan VIP status, Diamond status, and the ability to earn Aeroplan Miles on purchases from 3,000+ global brands. If you have any other Aeroplan cards, the annual fee of $599 is waived!

Benefits overview of American Express Aeroplan Reserve Card

- Enjoy the 85,000 Welcome Bonus Aeroplan points

- You can earn up to $2,600 or more in value within your first year

- Get Maple Leaf LoungeTM3 and Annual Worldwide Companion Pass

- 3X AEROPLAN POINTS On Air Canada

- Get a 24/7 Customer service and Fraud Protection Guarantee

Things you need to know before applying

Annual Fee: The annual fee of the card is $599.

Late Payment Penalty Fee: Late payments can make the APR of the card go higher.

Returned Payment Fee: The returned payment fee for the card is undisclosed.

Foreign Transaction Fee: No foreign transaction fees.

Interest Rate: APR is 20.99% on purchases and 21.99% on funds advances

Minimum Credit Score needed: 550 and above.

How to apply for American Express Aeroplan Reserve Card?

The American Express Aeroplan Reserve Card application process is purely online and accessible.

- To start, log onto the American Express Aeroplan website. From there, you will need to register your account to create a profile. This will allow you to create an account and manage your payment information.

- Then, you will need to fill out the application form. You will also be asked to upload your documents.

- After that, you will need to answer some questions about yourself and provide your contact information.

- You need to be 18+ years old and be a Canadian citizen. Once you have filled out the form, submit it and wait for the approval.

- If everything goes well, review the terms and conditions.

- Sign the contract.

Indeed, take advantage of a premium card that offers a flexible, global spending option for business and leisure travelers. With this card, you can get preferential access to airport lounges, priority check-in, priority boarding, and earn Aeroplan miles and status!